The Bitcoin Bull Market

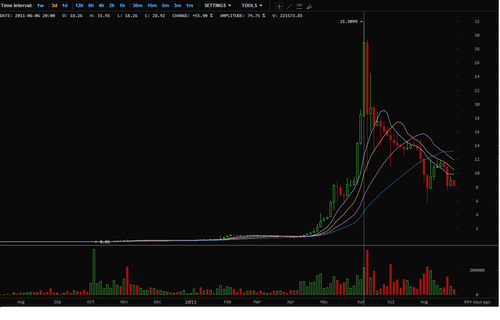

Let’s not overanalyze, let’s let the images speak for themselves:

Mt. Gox finished their pivot from a Magic: The Gathering card trading engine to a Bitcoin exchange in mid-2010, for a few months they did very little volume, literally dozens of dollars in total volume daily, and then the flow of Bitcoin miners who wanted to at least monetize their operating costs (which were just then beginning to become noticable) came in and flooded the market with supply. In one week in October of that year, 370 thousand BTC traded, driving the price to a penny, a dump of at the time about 5% of the money supply.

Eight months later, Bitcoin traded for $31.90.

This kind of thing doesn’t seem impressive to any professional market participants, penny stocks do this kind of thing sometimes, maybe not to $31.90, but to $5, or $12, or maybe $20. Watch the Wolf of Wall St. that kind of operation’s success was made possible by the petty imaginations of wanna-be traders fantasizing about such penny stock pops. The aftermath is almost always similar to Bitcoin’s Q3 2011 performance. I know guys who started Tradehill in Chile and they were making money off the trading volume in the next era of Bitcoin’s life.

Meet Bitstamp, the current leading exchange outside of Asia, with about 30k average daily volume, currently about 20MM in Dollar value. Back then, they had mere thousands (~50k USD) in avg. daily volume, then a couple quarters later, the daily volume reaches the six-figures in USD, and the 5-figures in BTC. They’ve had much bigger days recently. Back then, they started as the place to try and get a limit order out for cheap Bitcoins as the dumping came to a creshendo on Mt. Gox.

Another bullmarket happened in the same time frame as the year before, not making new all-time highs, sure, but quite a bull market nonetheless. This chart reminds me of the performance of many, many decent small-cap stocks from 2009 through 2012. It’s easy to look back and think of 2012 as a sideways year, but the truth is, Bitcoin has not had a sideways year yet, even though in the same 2012, Gold did have a sideways year (and its first big-time down year since the start of the century in 2013, but I digress).

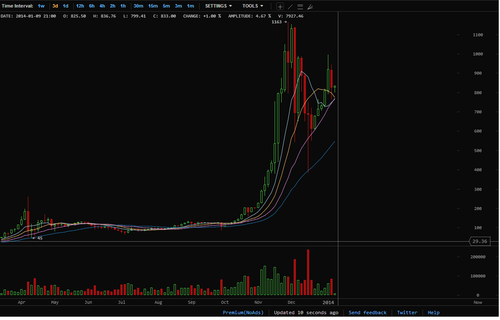

Now let’s fast forward to 2013’s…

…first half:

and second half:

Do you feel like you just watched The Hobbit? These charts look like a party full of successively taller fantasy characters.

So considering the blunt reality that this is the most epic bull market to ever exist in financial markets, one must be careful shorting, or even getting out into USD you don’t need. Unless you are a professional, or a very cool-headed trend-follower. Do not underestimate this tidal wave of change. With that in mind, I must caution myself, crashes will happen, I would like to profit from them, but likewise, it’s just as imaginable for Bitcoin to trade $500 higher as it is for trade $500 lower.

Just for some perspective:

The largest bubbles of the centuries when currency was growing up, the 13th through the 19th, did allow for 20x multiples, or even 100x multiples. South Sea company stock, Tulips, the NASDAQ, gold, all these bull markets produced returns in the multiples of tens or hundreds. Venture Capitalists make a business out of finding exposure to just one or two such returns in private, pre-IPO companies. Options contracts can, in double-digit % movement trend in the underlying, produce a peak-to trough return in that magnitude, sometimes, probably would have to be long-dated contracts and you hedge them with calendar spreads or diagonals periodically. Then you’ve always got penny stocks and ponzi schemes. These kind of returns exist in the history of financial markets.

Bitcoin has produced a total return since its early trading days of .01 USD to peak $1242 USD on that same goofy exchange, Mt. Gox - evokes some kind of mystical concept in its Japanese jurisdiction, a foggy place with thin air and even thinner market depth. Bitstamp’s all-time high is currently $1163. The peak-to-trough total return of Bitcoin on Bitstamp is precisely: 1,163,000% - this is the biggest bull-market on a CAGR basis in the history of financial markets.

DO NOT underestimate the upside surprise in cryptocurrency valutations, not on a single trading day of your participation in these markets. Also don’t underestimate downside volatility. Expect the unexpected, and expect cryptocurrency to envelop an increasing fraction of the global financial ecosystem. We are not talking about something as big as the IPO of Google, or even the creation of commodity futures markets and option markets, we are talking about something as big as the invention of the printing press and then the turning in of Tally Sticks in exchange for stock certificates in the Bank of England at its founding in 1694. But of course, cryptocurrency has more n common with the tally sticks than the BoE stock. The people of England used to use grooved sticks as currency, the grooves served as a locking mechanism that provided a sort of physical proof-of-stake and prevented easy counterfeiting. Which is funny because tally sticks and stakes are made of the same material.

Yes these are also the most volatile markets in the history of financial markets. Electronic networks have enabled markets to move at the speed of light, and greed and panic manifest as the speed of frenzied clicks. Keep your mind’s eye on the big picture, and you’ll do fine.