With Great Difficulty

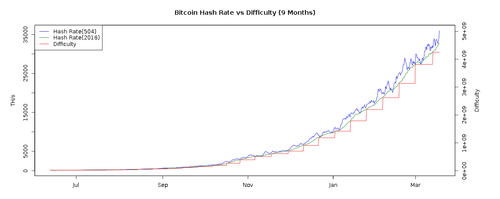

The most impressive thing about bitcoin is not the price, but the power of the miner network:

Just admire that performance. A rise from a twentieth of a penny to over a grand is about a two million-fold performance financially, but the miner network’s hashing power has grown by more than a billion-fold since 2009. If you could buy futures on mining difficulty, you’d have a pretty easy time.

That mining difficulty has exceeded price is no accident, it means the utility of capital expenditure is chasing marginal profitability, and it’s noteworthy that as the BTC/USD price has consolidated the past quarter, difficulty has continued a-doubling on the regular.

Coinometrics tracks an index of the cost of attacking the bitcoin network with a 51% attack, ranking it next to the annual military expenditures of small nations. It’s interesting to consider what it would cost though, if for example Lockheed Martin began manufacturing next-gen ASICs that were 50-150% more powerful and cost-effective in $/gh than the competitor. You build 10k, or 100k of those units for wholesale costs, and you go into business raiding the network with double-spends that can out-race confirms and crash exchanges with naked short sales. You know, like what they used to do to the gold market.

What then? The PR profile of cryptocurrency would be marred, perhaps moreso than the recent Gox bankruptcy. The die hards would move to another network, and businesses using token transfer as part of their services model would be able to continue operating using other networks. Litecoin would see a bump, but the specter of security on their smaller network strength would perhaps put panic into those markets sooner rather than later - as for the little national scrypts being teased to the market, like Spain and Auroracoin, or Mazacoin, the idea would spread that the US government can drone bomb your fancy rebel crypto tokens the way it might a school in Pakistan. Proof of stake would be the perceived salvation, from a user-base that isn’t fully aware of how it works. PPC and NXT would rally the hardest, as would Ether, while XCP, MSC and token markets built as a 3rd layer over the BTC blockchain would be thrown into disarray.

So the question then is, how cheaply can PoW/Pos hybrid currencys be made resilient against asymmetrically larger mining budgets, vs. pure PoS?

And the market will test that out in the form of a game of chicken between token sellers and central-bank funded traders whose job it is to buy out the currency to kill it.

This paper suggests that the game theory of market behavior would be panic selling against the notion that one’s tokens will be made worthless by a successful buy-out, causing a rush to the exits that makes the buy-out virtually free to the NYFed intern. My experience with markets would suggest otherwise, a bubble rush where hoarders accumulate profits and stetch their partial-profit goals further and higher, until after 50-1000x appreciation in price, the balance of inventory reaches a majority for the attacker, and hoarder confidence turns to profit-salvaging panic.

If a 90% holding is needed in a particular PoS currency to dominate the network, maybe the last 40 or 30% would be acquired on the downslope. This would nonetheless have the effect of giving hoarders in the currency at least tens of billions of dollars in profit on the open market, liquidity that would most likely buy any non-threatened crypto (except XRP, which is not to be trusted) and fly to outside banks or other crypto-markets. If the NYFed was trying to QE-to-death Proof-of-Stake cryptocurrencies, would you be really enthusiastic about wiring funds into the arms of Uncle Sam? Most likely you wouldn’t see that kind fo shenanigans unless the US banking system becomes enclosed by stronger capital controls than the light corral currently existing-by-reflex by FACTA and MSB licensing requirements.

Then you buy into the next PoS token stake and let the Fed try to kill that with another $30 billion, you get anti-crypto QE whack-a-mole.

If the idea of the Fed pushing up the value of assets reminds you of the US stock market, you might be wealthier in the future.

Bitcoin is not going to be the dominant cryptocurrency within 5 years. Let’s be real here, the blockchain takes forever to download on a retail computer, the last few months take half of that, and Mastercoin and Counterparty are in a race to fatten the average block up with escrow transactions. The core dev team is underfunded, especially relative to 2.0 projects like Mastercoin that are building off of their effort, the two top guys are busy with demanding day jobs for for-profit companies. Something is losing ground.

The network difficulty will continue to grow, but to really achieve enduring hegemony it needs to accelerate and reach the hundreds of Exa-hashes per second level, where the cost of Lockheed chip-spamming it into chaos becomes greater, and the odds of the more independent ASIC industry catching up stays level. If Lockheed were to roll out a product in Q2, they would stand a chance of bludgeoning the network, Q3, at this rate, would mean a significantly harder time taking down this crypto-insurgency.

You might suggest that NXT would make Peercoin obsolete as a life-boat against the security of the BTC network but all that money pumped into ASIC chips for SHA-256 could go to defending PPC’s network.

If anyone asks you what gives a bitcoin value, tell them 35 quintillion hashing calculations per second, and doubling every few months.