Hyper-fungibility in the Age of the Alt

Are alt-coins inevitably doomed to failure because of the prevailing liquidity benefits of being the #1 cryptocurrency?

If that’s true, then why is it that Litecoin trading volume has recently eclipsed Bitcoin? OKCoin, the top exchange for LTC volume, recently eclipsed Huobi for top BTC volume by a hair. The launch of LTC trading on Huobi and BTCChina may have galvanzed price movement in the ratio of BTC/LTC from ~.02 to over .03, followed by a harsh 22% pullback in the 36 hours following the debut of LTC on Huobi. But the truth is, those exchanges listing LTC isn’t really adding much to the volume, they are doing it to stay relevant against their leading competitor.

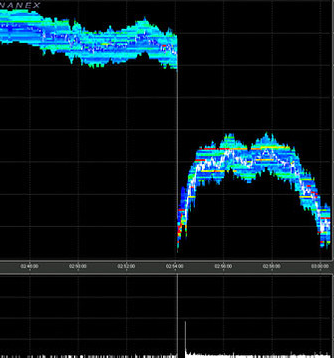

OKCoin volumes are still dominant, and lately their total CNY value has been greater than the greatest volume days in the history cryptocurrency trading, which happened previously in December and February. Huobi recently put up 353,000 BTC in volume during the panic following the end of Mt. Gox, worth about 180MM USD at the average price for that period. OKCoin is throwing up even bigger numbers recently 13.5 MM LTC @100RMB translates to over 200MM USD in value.

Meanwhile, in crypto 2.0 land, we were all pleased to see Bitcoin Core 0.9 released the other day. The immense weight of the blockchain is a technical shackle that you have to sit through to really appreciate, it becomes like a hobby, weeks pass as you catch up, with the last few months taking half the time. Now we’re about to start filling blocks with transactions for BTC dusts, about .00005580, big enough to qualify for a 40kb meta-data packet. That meta-data is going to allow token issuance and redemption.

So yes, most of the Scrypt coins are going to slowly whittle down in price and volume until the 3rd rate, easily hacked exchanges that host them decide to delist their obscure ticker. Lots of money was made and lost trading these coins, and that is that, with the losers being more numerous than the winners. But to throw distributed exchange protocols or Proof-of-Stake coins in the garbage can is missing the point.

Cryptocurrency is hyper-fungible. It trades inherently, its value is its ability to be traded, now that we’re about to shed these hold-over centralized exchanges as our weak-point and start doing escrow-based trading over the blockchain, it will be possible to provide low cost conversion of one alt to another. Just because those coins don’t have the majority in market cap, they can still have a higher liquidity factor, and they can offer a whole host of utilities other than being a capital stock, the way bitcoin works (or gold, in the era of Central Banks holding to hedge their money printing).

So, Litecoin is now traded broadly, with the top exchange actually doing more volume in LTC than BTC. You might say it’s just a speculators toy, with a psychological effect around its higher beta that makes it more volatile-for-the-sake-of-trading and in the process, hyper-liquid. But that is the whole point, speculator liquidity deepens potential use for commercial hedgers. It could be that the faster confirmation and easier psychological numeration, as trivial a pair of innovations though they are, will get Litecoin more traction for ecommerce and perhaps even Point-of-Sale wallets. It’s like a more grown up but still petty cash version of Dogecoin - which is a meaningful fluke showing us the value of a capital stock token is enhanced by its velocity, not just its market cap.

Right now it’s possible to cash out 100k USD worth of Chinese Yuan for a slippaged of about .5%, with no fee. Huobi still has more BTC depth so one could pump a similar amount for a smilar slippage right now. Meanwhile in USD-land, Bitstamp has an average slippage of 1-1.5% to get out 100k, and Bitfinex (now #2 BTC/USD exchange by volume) clocks in a little tighter, due to margin capital allowing short-term traders to add liquidity. For LTC, the OKCoin effect is not happening for USD liquidity, you could get 5k for .5% slippage. With Bitfinex adopting a maker-taker commission model, where 25k LTC monthly volume gets your limit orders filled with no fee, we may be able to help make that exchange the top USD exchange for both BTC and LTC, and making it quite cheap for people to tap merchant-level liquidity with LTC while tapping enough liquidity for escrow, export credit, house-buying, or trading account amounts of money with BTC. Maybe LTC is the liquidity pool that competes more with credit cards in terms of average cost-per-transaction, and BTC is the liquidity pool that services the financial economy that needs the multisig functionality of Mastercoin or Counterparty.

Then there is the question of using a Scrypt-alt as national ID promotion vehicles, where you spam free money at the population of a small, resource rich but financially troubled country, subsidized by the Cryptsy and Bter traders who punted Auroracoin to a market cap. bigger than Litecoin (temporarily, non-float adjusted). But if the one-token-to-rule-them-all theory is at least partially true, to the extent that more than 5 or 6 capital stock markets supporting the profits of a strong Proof-of-Work network or the cost-resiliency of a Proof-of-Stake, then the idea of sovereign coins is most likely to going to serve as a nice cash bonus for early adopters, effectively subsidizing a mass tutorial, instead of being a one-shot rocket to instant crypto-anarchy.

Instead, we need to re-think alt-coins and think more about alt-shares. Consider the following:

- a smart token representing an IOU for a stock of USD or other fiat currency deposits, the tokens trade in different issues, for each exchange or banking system where redemption can be done with inter-account transfer, but they are fungible to the extent that the reflect USD value at trivial conversion cost (like a penny lost to intermediaries per $100 converted).

- a smart token that doesn’t depend on liquidity, instead it’s issued when people buy a ticket to a show or a flight, so liquidity can come in an easy and trustworthy way in secondary markets, and increase the overall efficiency and ease-of-user-experience for ticketing in general.

- a smart token representing shares in an hard asset that is tied into local banking systems through the above mentioned IOU tokens and distributes dividends regularly.

- a smart token that is generated with an inflationary supply curve (like Primecoin) and exists to fuel the economy around a particular application. On use, it is partially burned (sent to an address with no private key) but partially distributed as fees for using a distributed application that is hosted by 3rd parties competing for those fees. The burn and inflation are calibrated against app usage and the first derivative thereof, to create low volatility in the cost of using the app while also having a dynamic and efficiently priced marketplace for yielding resources to the app. Apps could also involve smartFOB activations of devices like vehicles, hotel room key systems, or a smart vault locked with a cryptographic signature, they could also involve devices that track physical signatures to confirm physical deliveries.

- a proof-of-stake share series that allows buyers to support an NGO or municipal government with no dividend, but rather, regular referendums, the beginning of “cyber-democracy” of noocratic governance.

What makes these information systems usable to the point of significant added efficiency is the hyper-fungibility of tokens. The liquidity and security base of BTC as a capital stock incentivizing investment in the miner network is a powerful foundation, but what bridges the breadth of bitcoin usage between where we are now and full-fledged usage of cryptocurrency is the depth of extending bitcoin with this plentitude of other functions.

The ability to click someone coins that are redemable for USD deposits takes our objective as market makers - to make it low cost to buy and hedge or sell BTC in a value transfer - and it turns it into a one-click experience. That is possible because of the liquidity mechanics of leveraged betting (futures or CDFs) with smart token contracts that builds up the basis for crypto ETFs that have open supply interaction with those who want to deliver against a short-sale to close an arb or submit their shares for a longer clearing process of redeeming them. Then you get the mom-and-pop value transfers riding over this seemingly solid (but really, hyper-liquid) product.

You might suggest that Litecoin or Nextcoin would be irrelevant then, but the prior provides a liquid-enough alternative base with a weaker but more broadly participated-in network with a lower ASIC advantage, and if Mastercoin or Counterparty get this huge meta-token economy going, and then Bitcoin Core runs into scaling issues, switching routing to the LTC blockchain is a great contingency option to have. Likewise NXT is going to replicate a lot of these functions in a pure proof-of-stake system, which may prove the ultimate bomb shelter if PoW coins get serially brute-forced.

Last but not least, let’s talk about XNF a Ripple fork that issues its token supply based on audited gold in vaults around the world, with redemption possible via physical delivery, instead of the OpenCoin Inc. pre-mine supply against a tiny float, which sort derails XRP’s no-volatility transfer medium premise. You can actually redeem XNF for gold sent to your home address via insured courier, how baller is that, you can’t even do that with GLD.

I see a future where there are several pure-medium tokens backed by different institutions, mutual credit clearing networks, and even banks. Then there maybe a handful of capital stock tokens backing different blockchains, but probably there will be few and BTC or LTC may not be it ultimately, which tickers get there only matter to the speculators, for society at large, what’s important is a strong reserve base protecting core ledgers that provably trustworthy. Then you’ll have lots of narrow application commodity tokens with loosely adjusted supply, halfway between the capital stocks and the pure mediums. Then you’ll have the securities, which in a sense fuse the backing of the medium-oriented tokens with the capital stock model.

If you want to dismiss alt coins, it’s important to do so on the basis of capital stock forks of Bitcoin Core, rather than tokens in general. Ultimately for crypto to grow up, you’re going to have markets made for well-capitalized securities against BTC, LTC; XNF, XRD (exchange deposit receipts for USD) and probably deposit receipts for local currency in the jurisdiction where that security’s underlying asset is based.

Most importantly, the total market cap for securities and app-tokens, perhaps still trading on the BTC blockchain in 5 years, will be a significant minority of the total market cap of the ecosystem, and possibly greater than the market cap of BTC tokens. How would that be possible?Consider BTC at $5-10k, a market cap around FB stock between 100-200 billion USD, but the issuance float of gold and fiat-deposit backed medium tokens is at least 1 trillion. In that scenario, you could have 200BB worth of real estate shares, another 150BB in farm shares, 100BB in renewable energy shares, 50BB in financial management vehicles like the ones we are launching, and 20BB in private company stock. Maybe Litecoin is 5BB in this scenario.

This is why our objective with the Alt Market Making fund will not be trying to suppress volatility in Scrypt tokens other than LTC, not even PPC or DOGE, but rather providing liquidity in this new space and to the tokens associated with those 2.0 projects. The Alt Tactical Rotation fund’s portfolio may include LTC; AUR; PPC; DOGE ect. (more interested in Zerocoin), but there is a qualitative hunch that the crypt 2.0 tokens (NXT; MSC; XCP; PTS, and whatever ticker Ether has) will be the main event.

Don’t be a conservative about alts, if you’re already into BTC and balk at gold-bugs calling it a conspiracy theory, but then you’re anti-alt, you’re a bit silly. Don’t be an economic neo-liberal in the NAFTA/IMF sense either, be an economic neo-hyper-mega-liberal. Embrace the madness of tons of new tickers representing experiments in numerous financial functions routing together in a glorious metropolis of digital liquidity. Just be critical in analyzing the value propositions. Are most tokens out there valued on faulty premises by bush league speculators who deserve to lose their coins? Yes, same is true in OTC penny stocks, and yet that serves a useful purpose for 1 in N companies (or at least it did in the days prior to Super-Angel funds and overripe VC funding).

Welcome to the age of radical financial individuation. Welcome to the hyper-fungibility of a the alt-aeon.