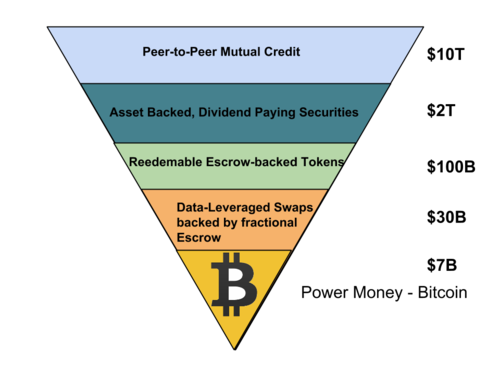

The New Pyramid

Money flows like a pyramid in our current system, and society reflects that form, specifically our fiat currency system uses a fixed supply of gold as “power money” on which many multiples of fiat credit are used in a flexible supply to allow us to trade and buy groceries with credit cards.

That system begins with gold buried in the vaults of central banks, who then swap freshly created fiat currency for government debt, it goes out to the banking system creating loans and thus fresh bank deposits for more loans, and after a decent amount of businesses make some profits to pay those loans and their employees, those employees try investing in stocks and bonds, until finally you get to the interest rate derivatives and all that. There are a few trillion bucks worth of gold, base USD cash supply is 1.something trillion, all the base supply of major fiat currencies are in the ballpark of the value of the gold. This chart shows base money, which includes all those T-bonds that the Fed has been buying, might raise an eyebrow or two. Bank credit (those dollars your bank statement says you have but are not in your hand) is over 10T. All those stocks and bonds and mortgage securities are in the tens of trillions, and the notional value of derivatives have exceeded and are now pushing 1 Quadrillion dollars, that’s uh, quadrillion with a capital “Q” for you right there.

You may have noticed this scheme is in peril, it’s been in the news. My entire Gen Y cohort is fairly spooked about stock market investing and trusting banks, having come of age in the 2008 financial crisis and entered the work force if only for the grace of Quantitative Easing.

Now we’re about to try something better, and not just politically better, but mathematically better, faster, easier to use, and more cost effective.

The general consensus among bankers, such as in the recent UBS analysis, is that Bitcoin the technology is cool, but bitcoins are not a good currency. They are right, bitcoins’ deflationary nature makes them a poor store of value for those with lots of short-term expenses. It’s good that the mainstream financial punditry is appreciating the value of the protocol, this is a big improvement from 3 months ago. They however, fail to connect the dots that the value of the tokens and their finitude exists to incentivize capex investment in the network via miners, which works to put a higher-and-higher cost to destroying the security of the network.

What bitcoins are useful for is to serve as power money. Though they are more spendable than gold, and indeed than USD deposits attached to the Visa network, the volatile price (a necessary part of the process in value-ing the capital stock) does preclude their raw usage by most people. I used them to get cashflow in a country with capital controls, at spot, for the lowest cost of any competing service (shadow hawala using SWIFT, XOOM, bond swaps, physically going to Uruguay to get $100 bills), but I am pretty damn far off from the mainstream consumer. Instead, we can use bitcoin as the settlement basis for digitally-encoded, 0-counterparty-risk swap contracts that allow bitcoin holders to hedge their exposure to the price of BTC/USD, and to get exposure to pretty much any other financial market. Since US-citizens who are long-term holders of BTC now face a capital gains tax event on their IRS-classified property, it opens the door to deferring that tax event while being able to invest with that capital base.

If I take a fraction of a bitcoin, margin it on Bitfinex to sell short 1 BTC, and have the rest of that 1 BTC invested elsewhere, I am basically just long those instruments. If I hedge a fraction of my bitcoin and send it to someone else to settle a debt, and they are selling it for a local currency different from the one I used to buy the BTC, same idea, we’re neutral to the price of bitcoin, but using the technology.

With Counterparty or Mastercoin, soon we can do that without having risk with an exchange (as much as I do trust Bitfinex, I prefer 0 counter-party risk to marginal). The deposits for each “bet” are visible in the blockchain, the trades are backed solid.

With that basis, it’s possible to make markets in tokens that are backed by redemption in gold, bank deposits, other capital-stock cryptotokens like Litecoin, or perhaps even goods and services (think about spot-tradeable reward points from a grocery store or airline). Obviously the real kicker here is to have a 100% reserve-backed token pegged and redeemable for USD or other fiat deposits. The direct redeemability will depend on interfacing directly with local banking systems to confirm a transfer of deposits, or using a bitcoin exchange’s accounts system, but if the market for swaps is liquid enough, it should always be possible to redeem the tokens for a proportional amount of BTC, like the old days of the gold standard provided for US dollars.

This opens the door to a lot more people using the technology for transfer and payments purposes without ever being long bitcoin, or even knowing or caring what bitcoin is, or that it is involved in the plumbing of the business service they are using to pay bills, load a wallet card, or receive money from a relative working abroad. You can have 10s of billions flowing through the network, with 50x the number of people using it, and the price of BTC at the base might only rise 2-3x in response. This is only a disappointment for extremely leveraged speculators chanting “bitcoin to $5000!”, who are somewhat missing the point from the other side of the spectrum.

Even if BTC/USD and let’s not forget, BTC/CNY is in a “bear market” range for the next several months, or even years, as long as the market is liquid, and users are parking to utilize superior financial services without fear of default or capital controls, the volume of the network can grow, and this will ultimately drive a stabilization and likely, a renewed up-trend in the price.

Once we’ve got a more efficient base for liquidity transfer into different localities, it becomes possible to tie local property title held by a corporate custodian in with the banking system of a friendly jurisdiction or 10, and start issuing securities backed by real-estate, farmland, renewable energy, manufacturing capacity and so on. The data provided by seeing how cash is settling as these things throw off dividends in USDcoin or ARScoin or CNYcoin and so forth provides a transparent basis for value-ing their discounted future cashflows. This will be possible with the tools that the Mastercoin project is adding to the Bitcoin network, and possible with Counterparty as well. Private equity in start-ups, potentially offering a less stable dividend, is another sector that could explode in capitalization.

Later, when Bit Shares and Etherium hit the scene, you’ll see huge growth in semi-automated and fully-automated businesses, the shares of which will be fully trade-able. All the interesting and essential places that capital needs to converge to make our future can be served by this burgeoning ecosystem.

Finally, how do we facilitate a low-volatility currency with flexible money-supply, that over a few decades could significantly complement the liquidity provided by political-fiat currency? You do mutual credit clearing, where everyone gets some credit limit and spends currency into existence. The allocation of credit limits could be handled by distributed autonomous organizations, which paints a picture of local governance and monetary control. If you can post your crypto-assets as collateral and/or have a business (these two become quite fungible if securities are liquid and transparent in cashflows) then you can issue a lot more credit. This is a long way off and just one theoretical model for how a usable currency could work in a cryptocurrency world.

The image at the top lists valuations, with BTC at 7B valuation, you can get up to 4x the notional value in play with the swaps, I’m proposing a 25% margin requirement in the initial spec, with 6-hour settlement, making futures seem a bit quaint, trading the rolling contracts re-capitalizes the escrow addresses with fresh bitcoin, and the worst-case scenario is the underlying (say BTC/USD) moves more than 25% in 6 hours and the winners take profits voluntarily. Now realistically, you aren’t going to get all the BTC tied up in these multi-sig swaps, but imagine that as BTC/USD regains $1000, the % parking in useful positions (hedges, interest, exposure to other indices) goes up, so you get something 1/10th as liquid as the CME’s futures markets.

Market makers can then trade spot in the redeemable tokens while hedging with leverage at the margins, and you can get another 3-4x amount of value in float with redemption happening a fraction of the time to keep the system honest, but otherwise just trading at spot with a 2-hour confirmation-based clearance is the clever thing (redemption would most likely take several business days). So we’re talking 100B of liquidity here, big enough for start-up’s to go eat Western Union’s and Visa’s lunch, with BTC “merely” trading at ~$500 USD. Getting to 1T in securities is easy, since that value is already latent, probably suppressed by lack of liquidity, in places like Argentina, Brazil, the Phillipines ect. - if you can actually implement a credible put option of the shares being linked to title backed by a court system (as a last resort), you could even get clever firms buying them up to re-package as AA-rated “paper” bonds sold to pension fund managers who have more billions to park than they can find qualified assets.

Then from $2T in solid, tangible, cashflow-producing wealth, you can get “real economy” trading activity going that pumps 3-5x the credit into a burgeoning system D economy that is currently the world’s largest, and could grow to 30-40% of global GDP as an international currency and fiscal crisis in G8 nations comes to its mathematically inevitable conclusion.

If you’re a BTC bull, thinking it’s only logical that this new financial system gains a power money base with a market cap. equal to that of Facebook, that last big thing, just append a 0 to all these numbers and you’ve got a complete vision of a possible future.

guaka likes this

guaka likes this omni-farious likes this

omni-farious likes this blanketpol likes this

blanketpol likes this- cryptocurrencyconcepts posted this