The Decentralization of Banking

For the past two months, I have been trying to puzzle out a way to do fiat-pegged tokens over the blockchain that is both financially sound and immune to regulatory capture.

My research journey took me through the world of offshore banking, how the actuarial math of bond re-insurance overlaps with Options Greeks, how to do trustworthy, signed data-feeds with stamping from services like Reality Keys and the cutting edge in API aggregation that would make bank deposit deliveries against an escrow of crypto-tokens possible, and the comparitive risk percolations in centralized and decentralized banking.

But in the end I couldn’t puzzle out a way to make the issuance of dollar coins and peso coins and other fiat-pegged tokens totally decentralized and immune. I conceived of trusts, system D delivery networks that clear crypto-sales with escrow signatures, and possibly more decentralized redemption using fiat transfer between accounts on a bitcoin exchange. None of these solutions seemed satisfying, they all were extremely centralized to start, and vulnerable, and bouncing them off the folks at CODA and the Mastercoin Foundation yielded an aura of regulatory caution. It is telling that the biggest killer-app of Crypto 2.0 - the decoupling of protocol use with the price of mining-reward tokens - is also the biggest “Here Be Dragons” sector when it comes to legal authorization. Securities have well-defined guidance, though that will need to be updated, but actually issueing something and calling it a “dollar” seemed too heavy metal.

In the meantime I did some work on the Mastercoin spec and now that the first smart property crowdfunding went off with a bang, I’m preparing to argue for PR approvals relating to a few must-have features, and the most complex of these is standardized cost-for-difference contracs, or “smart futures” as I like to call them. The goal is to have liquid order books where you can enter a contract at a certain price and almost immediately have BTC in a margin address square up against BTC already waiting in escrow, placed by the placer of the limit order.

The classic contract, the first to get really liquid, will be BTC/USD, you place .25 BTC to go short, the other person has .25 down to go long, and you’re each exposed to 1 BTC in notional value. The contract settles every 6 hours, which seems to be both the shortest and longest time that makes sense, in that period you expect less volatility, even in a flush-out rare event, than the leverage ratio of the contract. If BTC/USD were less volatile, you could roll a leverage ratio of 1:5 or 1:6, but even the S&P 500 futures have 10% down-moves in 6 hours sometimes, so I doubt we would ever see 1:10 leverage. You can offer similar contracts with those higher leverage ratios on stock indices, currencies, commodities, interest rates, anything with a liquid market to hedge into and a data feed from a trusted source. The edge-case of a crazy volatile move within 6 hours means people making profit on the contracts may get profits taken automatically, nothing too disastrous (unless depending on those contracts as a hedge).

While creating a financial supermarket/video-arcade is very interesting, the real magic comes when you consider the derivative math of this hard-escrow backed contract.

If you create this 1 BTC of notional value at a specific price, say $500 USD, using .5 BTC in collateral, have you not just introduced a solidly measurable form of a $500 USD crypto-deposit?

We’re getting into Zen riddle territory here, let’s look at it another way:

What is the difference between selling 1 BTC for $500 on Bitfinex as an exchange transaction and short-selling 1 BTC on margin @$500 with 1 BTC in collateral?

The answer? If you do the spot exchange you need the entire 1 BTC, and in exchange you get a promise that Bitfinex’s bank in Hong Kong owes them $500 that is on deposit there, that they are saying is in your account. So you’ve got these layers of counterparty risk with these centralized institutions. If you short 1 BTC against 1 BTC in margin, you only have counterparty risk with Bitfinex’s walleting system.

Now, take away that counterparty risk with Bitfinex’s walleting system, you just took a quarter of your 1 BTC and entered a smart future short 1 BTC on the blockchain, automatic roll over of the contract every 6 hours.

Mathematically, selling 1 BTC for $500 on an exchange so their bank and corporate liability owes you fiat, selling short 1 BTC against 1 BTC collateral on Bitfinex, and shorting 1 BTC against 1 BTC on a decentralized network are exactly the same.

1) If BTC/USD rises to $600 or falls to $400, I still have that $500 deposit with the exchange’s licensed banking partner.

2) If the price rises or falls that $100, I pay $100 to close out the short 0.8334 BTC is now worth $500. If it falls $100 I now have 1 BTC worth $400 and $100 on deposit

3) If the price moves up $100, the person who went long gets .1666 BTC and I have .8334 BTC worth $500, if the price moves down $100, my short contract pays me .25 BTC and I have 1.25 BTC worth $500.

So, if they’re mathematically equivalent, but doing it with smart contracts lacks all institutional, counterparty or regulatory capture risk, then we can create fiat-currency deposits through pinning BTC against each other in smart contracts tracking the exchange rate of BTC to a given fiat currency. However just shorting the .25 BTC at $500 isn’t enough to back issuance of $500 in dollar coins. You need reserves.

How much of a reserve? To start, let’s consider putting up the full bitcoin, maybe you just paid $500 to buy 1 BTC and how you want to issue USD off of it. You send .25 to the margin escrow to back the hedge contract, and you park .75 in a deposit address. These two accounts interact as contracts roll over and the amount of BTC that constitutes the original $500 shifts around. Now you’ve got an algorithmic banker fixing a quantity of BTC in an automatic dance through addresses, and on that basis you can certainly issue $500 USD in crypto-token IOUs that are generally fungible for redemption in BTC with any other party doing the same thing.

This means the total BTC value involved in issuing USD credit or other fiat denominations is .25 on the long side, as the insurance of that USD value, plus 1 whole bitcoin on the short side, for a reserve ratio of 20%. As markets get more liquid and the volatility goes lower, the leverage ratio of the contracts can increase until the reserve ratio is closer to 12 or 14%.

Or to put it another rate, this is banking with a 120% reserve, possibly get it down to 112%, this is distinct from fractional reserve lending.

Now there may be ways to put up less than that .75 in the deposit escrow to issue the 1 BTC @contract-value number of fiat units. It would mean an issuer would be leveraged short instead of net-short, and they would run a margin call sooner. You may have noticed that because the decentralized contracts pay out in BTC, keeping everything blockchain based at settlement, the short-side margin gets more price movement before it’s called. At $1 price gain above $500 loses me $1 worth of BTC, but my BTC is becoming more valuable, my loss equals the value of .25 BTC at $666.66 cents. So why not lower the deposit reserve requirement so an up-move in BTC/USD of 25% closes the contract just as it does with a 25% down-move. A 25% up-move from $500 reaches $625, the .25 BTC at that price will be reduced to $31.25 worth of BTC, or .05.

If we let people issue USD against 1 BTC/USD smart contract plus .5 instead of .75 BTC in reserve, the issuer would be naked short .25 BTC at that price, which means they’ve got $343.75 USD wroth of bitcoin to roll over, against $500 they have issued, and that $500 has a 1:1 ratio to the BTC used to issue it. .25 BTC was used for the long contract, .25 BTC against it for the short contract, and .5 BTC in reserve, 1 BTC contracting at $500 issues $500 in crypto-dollars - seems beautiful.

Of course there’s no way we could allow that margin of extra lending to make decentralized banking totally capital efficient, unless…

What if an issuer could buy call options?

What if you put up 2 BTC deposit plus 1 BTC margin, shorted 4 BTC at $500 to issue $2000 dollar coins, and then bought 1 Call option to guarantee that missing 1 BTC at $625. What would that call be trading for at $500? If it was a front-month contract, and BTC has realized volatility like a mad, 50% in a month easily, I wouldn’t sell you that call for less than $120, but that’s me. Maybe $75 for a front-month, $95 for an 8-week, $120 for a 12 week.

You know what being net-short options is like? It’s like lending someone money, you always have more risk than reward, and time-value is a big factor. Market Makers who are always net-short options tend to rely on leveraged delta-hedging to grow their hedge position from a fraction of the notional value they would owe at exercise, to the full amount.

So Party A goes short against Party B @ $500 x 4 BTC with 1 BTC in margin, Party B puts up 1 BTC and another 2 in deposit reserve, issue itself $2000 dollar coins while buying a 1 BTC Call Option sold by Party C with a strike price at the shock price of the futures contract, $625 (25% greater than entry). Party A is shooting for a speculative leveraged profit from Bitcoin going up, Party C is taking a big risk but earning a steady time-based profit from the option premium decay, and Party B has done 2 kewl things:

1) Moved $2000 USD from the banking system to a totally decentralized internet cash system.

2) Borrowed $500 of that $2000 by paying a premium for the 1 Call Option, where the decay rate of that contract’s premium is equivalent to an interest rate.

The moving part was made possible by Mr. Directional Speculator (Party A) and the borrowing part was made possible by Ms. Time-based Investor (Party C). Now if Ms. Investor were making a business out of selling options, she would have an automated delta-hedging program taking these leveraged-long contracts to increase her upside profit in BTC/USD as the price rises towards her short-strike prices, so if she were short 1000 Calls at $625, she’d have 125 BTC margined to be long 500 BTC by the time price reached that point (at-the-money options have a delta of around .5) - thus the snake eats its own tail.

Unlike the shadow banking systems in the US or China, where shaky collateral for chains of derivatives requires human trust and the enforcement of contracts via court orders means the whole thing can go non-linear dominoes, this system is backed by hard math and code.

Ok wise-guy, but what about the margin rules for the Call Option sellers? You can back a sold option with a cheaper option, but the Market Makers will have to be selling the furthest out options ultimately, most of the time. You can back a sold Put with cash, or even dollar coins issued with these BTC swaps described above, but you can only back a sold Call with 1 unit of the finite supply of bitcoin. They can either pony up the whole BTC at the time they write the Call, or they can pony up .25 and get a notional exposure of 1, or they can buy in bits and pieces, delta-hedging along the way. So now we’re back to the old reserve issue, the total BTC used to secure issue of 1 BTC worth of fiat-tokens is getting rather large again.

But here lies the magic. As the BTC/USD market gets more liquid and stable, in part due to all this money buying and parking in BTC so it can be short-sold to transform into crypto-dollars and then covered periodically, then we can lower the leverage ratio. When we lower the leverage ratio, let’s say to 1:5, now a 20% down move is $420, and a 20% up-move is $600. So now I, the new-USD issuer, want to buy that $600 call instead of $625, since volatility is lower, the option-seller is down to sell me that closer Call for a similar premium. In the process, the total capital efficiency of $ worth of BTC turned into $ worth of crypto-dollars gets higher, and maybe, just maybe, you can create a money multiplier.

The worst thing that could happen with this system is not a BTC market crash, but rather, a spike in price, most likely fueled by short-contract covering but also by general mania as we have seen, where the people who have sold Calls to the short-sellers to limit their loss are getting their delta-hedges closed out prematurely, the move is just too fast to roll the contracts over within the 6 hours, and assuming 1 fungible issue of crypto-dollars originating from anyone with BTC to margin and reserve, then you might see $1000 worth of crypo-tokens trading for .97 BTC with BTC/USD at $1000, people want to be able to get more of these USD coins for their effective money to offset the risk that a rush to redeem the USD coins for BTC would crush the open interest of the smart futures and leave no BTC in deposit addresses to redeem for fair value. The 2008 financial crisis raised the specter of this happening with fiat banking, and the money market accounts actually traded at a discount to $1 par, like our theoretically distressed crypto-dollars. The most extreme tail-risk then, is people who are using dollar coins as a credit card or savings surrogate, are left at a loss, if the whole system dries up and there are outstanding dollar coins with no BTC backing, how do you re-start the system and what are the rules of making people whole? It’d be like decentralized Mt. Gox.

The thing is, when price is going way up like that, you’d expect people to want to buy Calls and go long smart futures, and you’d expect people to not want to be leveraged short. One way would be to treat the call-option decay as interest on that borrowed-into-existence dollar-coin balance, and use it to buy more BTC at-spot. If fewer people are getting leveraged short, the premiums for Calls are probably going to get really high, selling a Call is a way of being leveraged short as well. You get to the point pretty quickly where it’s cheaper to straight up borrow fiat from your credit card or old-school bank or lender on Bitfinex than it is to buy Calls. So long before you get to systematic short-fall from an extreme imbalance in volatility and liquidity, you have these layers of adjustment to the cost of “borrowing” that balance things out.

Obviously anyone selling Calls should have to post a fraction of their settlement value as collateral, in certain brokerage accounts I can sell a naked Put on XYZ at a $100 strike without putting up $10,000 to be ready to actually buy the stock, I can do it with $2,000 risking a magin call, it’s smarter to sell a larger number of Put spreads (sell $100 Put, buy $90 Put) and collect a similar credit, but with more flexible risk. Some brokers will also allow a naked call sale for 20% the cash-value of the stock at that price, you get a margin call if the thing runs 20% in-the-money. As a business, if I were short a deep-out-of-the-money Call and a deep-out-of-the-money Put, only risk one contract being exercised at a time, so I should be able to get capital efficiency by getting double margin value in collateralizing both contracts.

In analyzing the risks of issueing more dollars than the dollar value of all the Bitcoin, I fear I’ve missed the greater issue, so I’ll repeat, we can cleanly issue 80% of the USD value of participating bitcoin as USD coins, the people who post their BTC can get these digital dollars that move across the blockchain, and everyday people can use it with a spending card that has QR addresses on it, or to send money around the world. This in itself is huge, and it means you can get the market cap. of BTC way higher as real adoption picks up, and maybe 20% of the BTC is being banked in this manner, with another 5% leveraging long, and right there you’ve got several billion USD worth of crypto-tokens floating around being used for savings, spending and business. Huge.

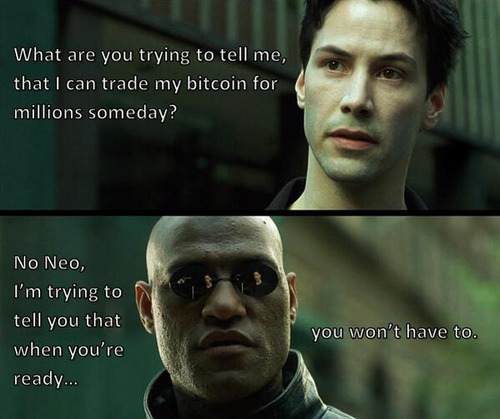

That little piece of financial engineering is like the invention of fire, after you get yourself a little bit of technology (flint and tinder or blockchain cryptographic verification) the first thing you do on the desert island is make-a-fire/issue liquidity. It is possible to fix value and circulate it without everyone being speculators, and without the permission or co-operation of any banks or regulators. The borrowing against options contracts and the rules that make sure options-sellers don’t go bust take that camp fire and turn it into electrical power for home and municipal lighting, but that comes later.

By the way, yesterday I found out that Everbank is closing my business and personal accounts, I had the latter for over 2 years. They wouldn’t explain why, but I did tell them I was making a wire to buy BTC last month, this may have been a factor. When my bank dumps me for using Bitcoin, I use Bitcoin to dump banks, forever.